Cheap oil was, arguably, the most important driver of prosperity in the industrial world during the 20th century. Expensive energy is one, but not the only significant driver of the economic Mode Shift occuring in the 21st.Â

Today, just in time for gas prices here in Benzie County to edge close to $3.00 again, and with news of $90 a barrel oil this week, comes the latest independent assessment of global oil stocks. The conclusion that the German-based Energy Watch Group reaches in its new report is that the world reached the peak of oil production last year, and that oil production and supplies will steadily decline by 2 percent annually for the time being.Â

Energy analysts were wrong earlier this year when they predicted that gasoline prices would reach $4 a gallon last summer. But I’m sticking by my prediction that gas could climb to $5 a gallon next year and if it does that issue alone will dominate the 2008 presidential election.

The United States, much to everybody’s amazement, has been responding to the peak oil threat, rising gasoline prices, or other features of the swiftly changing landscape of energy use, supply, and price, but not in ways we expected. Nor have the changes occurred with sufficient speed.

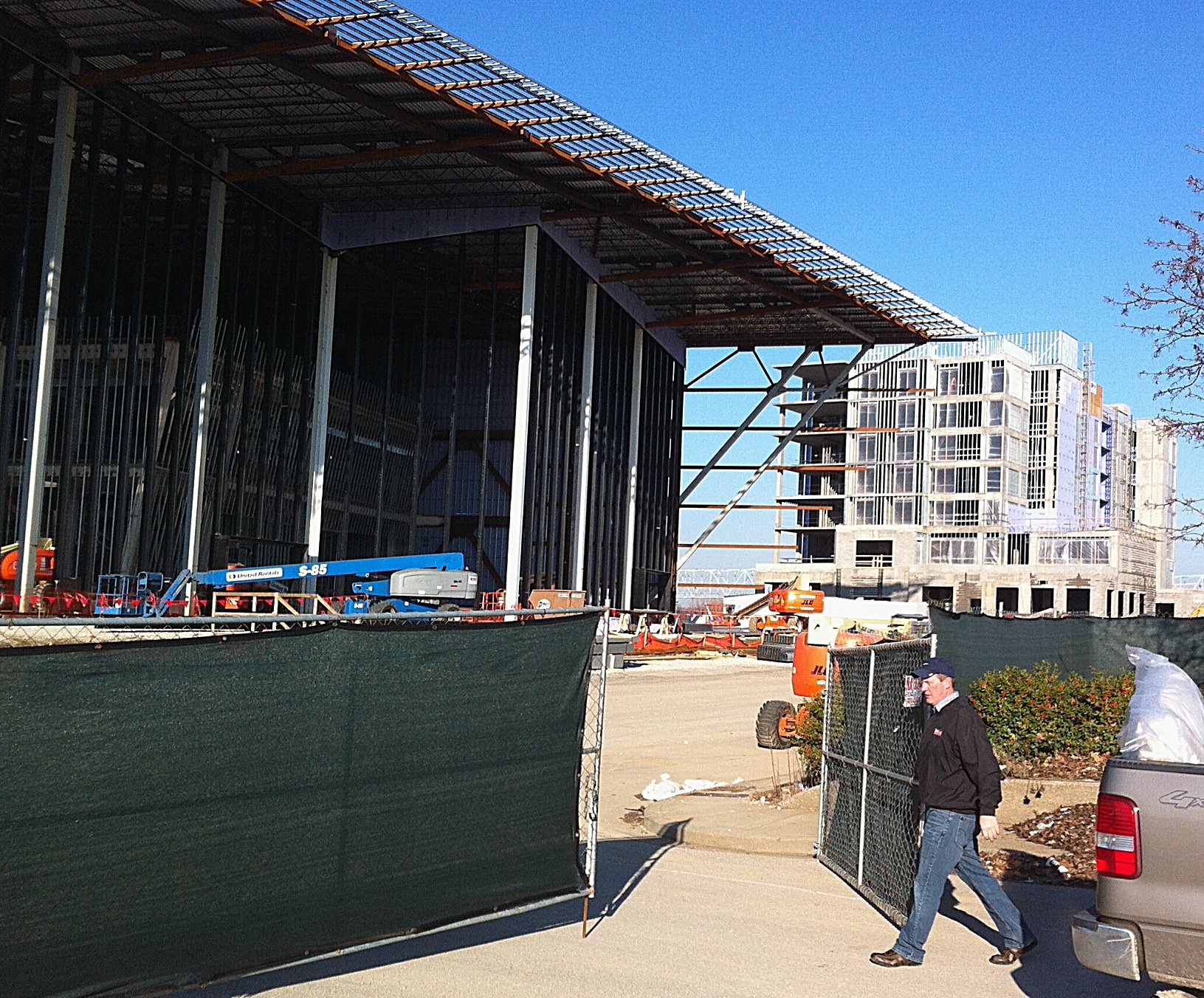

For one, more people, especially young professionals and empty nesters are moving to city centers, which have become the hottest housing markets in an otherwise slumping national sector. The South Loop along the lakeshore in Chicago, which I visited last week, is a soundscape of heavy equipment, saws and hammers, and diesel motors. Hundreds of new townhouses and apartments are under construction, and two of the projects — see eco18 – market their green qualities as competitive features.

The number of new rail transit lines grows annually. Seattle is building a light rail and a streetcar line to serve the 680,000 residents expected by 2022, according to city planners, 100,000 more than today, and the 50,000 new downtown jobs.  Transit ridership nationally is reaching levels not seen in 50 years. Even KansasCity voted last year to build a new light rail line.

States and the federal government are pouring research dollars into the science of developing fuel from cellulosic ethanol. Michigan State University is a center of that research, having attracted a $125 million federal grant last summer that it is sharing with the University of Wisconsin.Â

Those who can afford it are changing out their gas gulping vehicles for higher mileage cars. The hybrid Toyota Prius is among the most popular cars in the country now.

But there is a dark side, and that is the influence of expensive fuel in contributing to the suburban and ex-urban housing depression. The problem is tied not only to interest rates adjusting up in the subprime market, it also is linked to declining incomes and higher costs associated with transportation, now the number one or two expense in most American homes. More people are having a harder time paying their mortgages, and not just here in the strapped Midwest.Â

The result is that homes set far from jobs just aren’t as attractive as they once were. During the 1990s, a boom time, the Detroit metropolitan region was spreading out at a rate three to ten times faster than growth in population. Today, many of the people having the hardest time selling their homes in Detroit, mid-level auto industry managers who’ve been systematically displaced from their jobs, are those who bought in the new and distant subdivisions. Â

What is so worrisome is that the people hurt most by this transition are the very same folk who voted for the narrow-minded, do nothing, government-is-the-problem candidates. Those guys, abetted by weak Democrats, have been so successful that neither the federal nor the state governments really are capable or confident that they can make some difference.Â

There is a policy response here to speed the transition to a much more energy efficient, transit-friendly, compact community, affordable way of life in the era of fast rising fuel prices. The federal government can leverage its vast treasury for research, infrastructure, and investments to do such things as speed the development of high-mileage vehicles and construct regional high-speed rail networks.Â

We’re going to get there. Americans will finally demand it. But we’ll be years behind, chasing ever-escalating gasoline prices.Â

Most days I’m optimistic that innovation and hard work will help us avoid the worst. Today I’m not. I worry about the hard time that awaits us. Â

Keith,

Once again your spot on.

Tom,

You just look at the drought, the fires, the hurricanes, the blowing dust and sand in China, and it ain’t hard to make the connections.

It was good to see you in Oak Park. The foundation committee offered the job but we couldn’t agree on the financial numbers. It would have been fun. If you have something that looks interesting down there, let me know. Best, Keith

Keith,

The report you are referring from The Energy Watch Group is so serious that it has to be kept a secret. Atr least, that is what our leaders think. They are hiding the facts from us. I took particular note in the conclusion (excerpt):

“The now beginning transition period probably has its own rules which are valid only during this phase. Things might happen which we never experienced before and which we may never experience again once this transition period has ended. Our way of dealing with energy issues probably will have to change fundamentally.”

I dare not translate these words into reality for our kids and grandchildren.

Useful post,You gain knowledge of something new every day.

Pretty nice post. I just stumbled upon your weblog and wanted to mention that I’ve truly enjoyed browsing your weblog posts. In any case I’ll be subscribing to your rss feed and I hope you write again soon!