PADUCAH, KY. – On a mile-wide reach of the Ohio River, just upstream from where it converges with the Mississippi, Ray McKinney, the 54-year-old first mate aboard the Mike Weisend, a year-old towboat, pounds the slack out of steel cables that lash 15 barges together in a long tow headed upriver.

The heavy pipe in his hands, and the tangle of cable at his feet are familiar equipment used by deckhands on the Ohio, a central artery of American commerce for nearly 250 years. But the load of cargo that the 6,000-horsepower towboat is readying to push upriver is not that familiar to McKinney and the eight other crew members aboard the big boat.

Instead of the usual load of coal, more than 25,000 tons of iron castings fill the barge holds. The towboat, essentially a floating locomotive, will push the 1,000-foot tow – three barges wide and five barges long — against the current for 400 miles to a steel plant in Ghent, Ky., about midway between Cincinnati and Louisville.

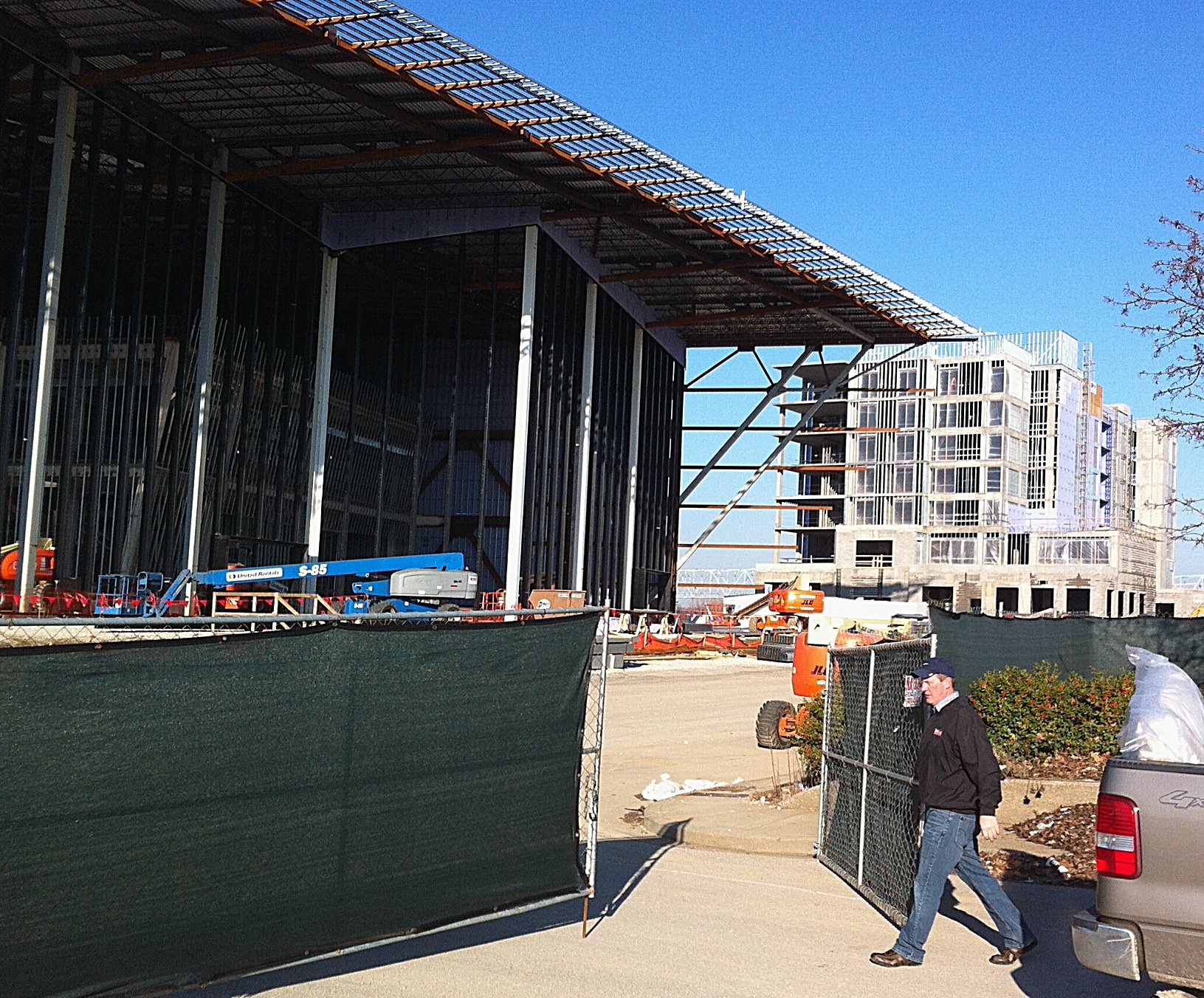

Business at the iron and steel foundries in Kentucky and Ohio is soaring. Vehicle manufacturers are ordering more steel. Steel pipe and steel construction equipment are needed to tap the deep natural gas-saturated shales of Ohio, Pennsylvania and West Virginia. The abundance of less expensive natural gas is encouraging construction of advanced manufacturing plants. General Electric, for instance, is in the midst of an $800 million program in Louisville to retrofit buildings to make new types of appliances. The company said it had hired nearly 900 workers this year and would hire several hundred more.

New supplies of natural gas also are helping to prompt utilities to replace power generated from coal-fired electric plants with newer, less polluting natural gas power plants. Coal mines are closing and less coal is being shipped on the river.

In other words, the iron castings are evidence of a seminal economic transition that is unfolding in the six-state Ohio River Valley, a region of economic revival that once encompassed much of what used to be called the rust belt. “The coal trade is way down,†notes Mr. McKinney, who’s spent more than 30 years moving bulk cargo on the Ohio River. “But we’re doing a lot more commercial cargo now. We’re seeing more steel, more rock, more cement. Somebody’s making money.â€

Today, The New York Times published my report on the six-state Ohio River Valley’s economic recovery, a narrative of unexpected job growth and financial performance that has implications for the November presidential election, as well as prospects for the nation’s well-being. For more than two centuries, the Ohio River Valley has led the United States into epochs of industrial prosperity as well as eras of decline. The new economy developing along the river corridor joins the bedrock industries of the region – energy production, manufacturing, transportation, and agriculture – in a new web of 21st century sectors — the Internet, higher education, more vibrant urban centers, and healthcare. My clear sense is that what we are seeing in the Ohio River Valley is a curtain raiser for the coming strength of the national economy.

There are many ways, of course, to assess economic performance. On Wall Street and in Washington, distinct facts about product inventories, plant openings, business starts and employment are assembled into economic assessments, most of which report that the national economic recovery has stalled.

But those same conventional metrics tell a different story for the Ohio River Valley. Between June 2011 and June 2012, Ohio generated 100,000 new jobs, the fourth leading state in job generation behind California, Texas, and New York, according to the Bureau of Labor Statistics. Indiana, with over 51,000 new jobs, ranked 10th during the same period, and in July added 12,500 more jobs, the most new jobs of all but three other states. West Virginia’s unemployment rate in July was 7.4 percent, according to BLS figures, nearly a full percentage point below the national rate. Pittsburgh’s jobless rate was 7.1 percent.

By virtue of transporting the basic bulk materials that make the country work, Mr. McKinney the other eight crew members aboard the Mike Weisend are afforded a closer and, arguably, more immediate weekly measure of the economy. The details they are piecing together as they drop tows of steel at modern plants in Kentucky and West Virginia, and pick up tows of chemicals and grain in Ohio and Illinois, are evidence of the steadily strengthening and modernizing economy evolving along the Ohio River Valley after decades of rust belt decay.

“We’re getting busier and busier,†said Luke Patterson, (in pix above) who is 31, a West Virginia native and resident, and one of the towboat’s two pilots. “There’s more traffic on the river. You can tell that things are changing.â€

“Give the region some credit,†said Mark Muro, a senior fellow and director of policy for the Metropolitan Policy Program at the Brookings Institution in Washington, D.C. “It’s rejected the narrative of decline and the theory that we would be just fine if we designed our goods here, but produced them offshore. What’s turning out to be the case is that production can occur here. Our strongest industrial sectors are still based in that very region of the country.â€

Arguably none of the trends that Mr. Patterson and his mates encounter are more visible and telling than the trade in coal. As recently as 2010, the last year for complete figures, 122.7 million tons of coal was shipped by barge on the Ohio River, according to the U.S. Army Corps of Engineers. That was more than half of the 220.6 million tons of total cargo that moved upstream and downstream that year on the Ohio.

This year, towboat companies anticipate that Ohio River coal shipments could fall to around 110 million tons. Kentucky’s coal production in the first three months of 2012 fell to 26.3 million tons, five percent less than during the same period in 2011, according to the Energy Information Administration, a statistics unit of the federal Department of Energy. West Virginia’s 2012 first quarter production, 32.8 million tons, was down 7.2 percent from the same 2011 period.

Yet even with diminishing coal shipments, Ohio River cargo traffic is climbing overall, and towboat companies are expanding. One place to measure the trend is at Lock 52, downriver from this city of 25,000, where much of the Ohio River barge industry is based.

Shipments of cement, steel, chemicals, grain, and commodities other than coal passing through the lock averaged 4.67 million tons a month this year, according to Army Corps records. That’s an average of 214,000 tons more cargo that passes through the lock every month, or an increase of five percent since 2011.

AEP River Operations, the subsidiary of Ohio-based American Electric Power, operates 3,200 barges and 90 towboats, including the Mike Weisend. The company anticipates that its commercial traffic will grow to 46 million tons this year, 2 million tons more than in 2011. “We’ve added 300 barges to our fleet through acquisitions,†said Tim Light, AEP’s senior vice president of fuel, emissions, and logistics. “We’re seeing increased volume on our fleet and we are optimistic about our long term prospects on the river.”

For two generations, few places so darkly illustrated the erosion in American industrial vitality, and the heart sore circumstances of its people, than the Ohio River Valley. The 981 miles of river from Pittsburgh to Cairo, Ill., strikingly beautiful as it flows past rounded hills, also drained a landscape of shuttered plants, broken towns, and lives bent by lost jobs and frantic worry.

To some extent, the rust hasn’t been rubbed off of some river towns, particularly those tied to the coal mining and coal combustion economies. In July, for instance, the Ohio Valley Coal Company announced it would cut 29 workers from its Powhatan No. 6 Mine in Belmont County, Ohio, which lies across the Ohio River from Wheeling, West. Virginia.

“The communities that host the industrial jobs, that have power plants or are tied to the coal industry are really suffering,†said Pat D. Hemlepp, a spokesman for American Electric Power. “A number of coal-fueled power plants will be closing in the next couple of years and that has many river cities in southern Ohio, northern West Virginia, southern Indiana and Kentucky concerned.

“I’m originally from Ashland, Ky., a river city, and still visit there every few months. If you looked at the economy in an Ashland, or an Ironton or Portsmouth, Ohio, or a Huntington, W.Va., you’d get a much different view of the Ohio River economy. The job market is pretty depressing in those areas.â€

Aboard the Mike Weisend, though, crew members notice they are towing more materials more often to plants that are operating at capacity, like the Gallatin Steel Company in Ghent, Ky. There also are more jobs in the river barge industry. Crew members work two six-hour shifts for 21 straight days, followed by 21 days off.

“It takes a little time to get used to it,†said Brandon Detty, the 27-year-old assistant engineer, from Chillicothe, Ohio, who’s worked on the river for five years. Mr. Detty said his paycheck totals about $1,100 every two weeks. Towboat pilots typically earn $80,000 to $110,000 annually. “But you also get to be home. And when I’m home I’m not working.â€

The $12 million Mike Weisend, one of the newest towboats in the Ohio River fleet, is designed to help AEP retain its towboat employees. The boat has comfortable private rooms. Crew members eat well thanks to 44-year-old Caroline Pollitt, the cook. “It’s nine people to feed every day,†said Ms. Pollitt, who lives in Vanceburg, Ky., and is the mother of two grown sons. “I care for them like family.â€

One thought on “Rust Rubbed Off Ohio River Valley, Narrative of Economic Revival in New York Times”